Roth ira calculator 2021

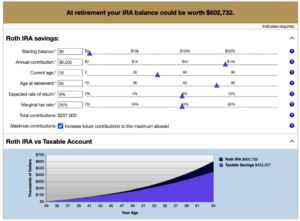

IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. A Roth IRA is a retirement account that lets your.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth IRA Calculator Roth IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. It is important to. This limit applies across all IRA accounts.

9 rows Amount of Roth IRA Contributions That You Can Make For 2021 This table shows whether your contribution to a Roth IRA is affected by the amount of your. We automatically distribute your savings optimally among different. We assume you will live to 95.

For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. Roth IRA Conversion Calculator. If you already have a Traditional IRA you may be considering whether to convert it to a Roth IRA.

For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. We stop the analysis there regardless of your spouses age. The Roth IRA has a contribution limit which is 6000 in both 2021 and 2022or 7000 if you are 50 or older.

This calculator assumes that you make your contribution at the beginning of each year. Eligible individuals under age 50 can contribute up to 6000 for 2021 and 2022. This calculator assumes that you make your contribution at the beginning of each year.

This calculator assumes that your return is compounded annually. One of the most important factors in the decision is what. See the impact of employer contributions different rates of return and retirement age.

Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings. This calculator assumes that you make your contribution at the beginning of each year. You can adjust that contribution.

The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. For instance if you expect your income level to be lower in a particular year but increase again in later years. Eligible individuals age 50 or older within a particular tax year can make an.

Single filers have to make less than 129000 in 2022 up from 125000 in 2021 to make a full contribution to a Roth IRA. For comparison purposes Roth IRA. It is important to.

The Roth IRA Conversion Calculator is intended to serve as an educational tool and should not be the primary basis of your investment financial or tax planning decisions. Annual IRA Contribution Limit. The Standard Poors 500 SP.

Converting to a Roth IRA may ultimately help you save money on income taxes. The actual rate of return is largely dependent on the types of investments you select. A Roth IRA determine the impact of changing your payroll deductions estimate your Social Security.

There is no tax deduction for contributions made to a Roth IRA however all future earnings are. Choose the appropriate calculator below to compare saving in a 401 k account vs. Project how much your Roth IRA will provide you in retirement.

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Ira Calculator See What You Ll Have Saved Dqydj

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

The Ultimate Interactive Roth Ira Calculator Blog

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculator Excel Template For Free

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

What Is The Best Roth Ira Calculator District Capital Management

Download Roth Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro